Gulf Insurance Group-Kuwait consolidated all their digital offerings into one solution with Liferay DXP.

Insurance Company Increases Customer Base by 30% with Better Digital Experiences

20,000

active Users

30%

Increase in Customers

100%

Products Available Digitally

Outline

Jump to Section

Key Takeaways

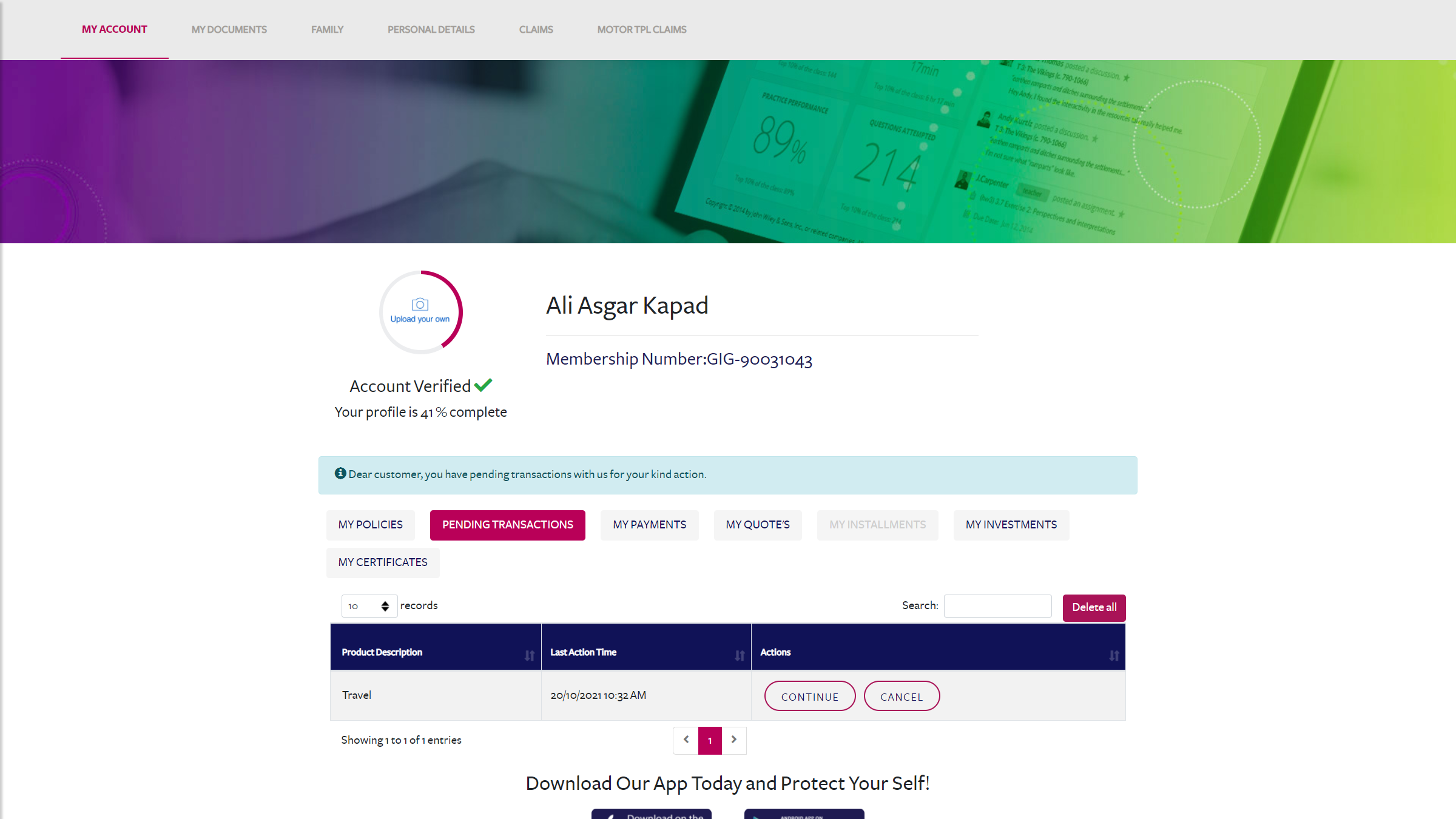

- Attract more customers with a seamless digital experience.

Now that Gulf Insurance Group-Kuwait’s website, customer portal, and web applications are hosted on one solution, customers can easily navigate between sites without disruption. - Embrace online options in an era of change.

With digital availability becoming more important than ever, Gulf Insurance Group-Kuwait shifted 100% of their products online and enabled customers with self-service to submit claims, request quotes, and more on their own. - Decrease time to market using the right functionality.

Out-of-the-box Liferay functionality like Liferay Forms has helped Gulf Insurance Group-Kuwait publish updates and improvements faster.

Background

The largest insurance company in Kuwait, Gulf Insurance Group-Kuwait offers products and services including automotive, marine and aviation, property and accident, engineering, and life and health insurance. In cooperation with major international insurance companies, Gulf Insurance Group-Kuwait strives to specifically and uniquely meet the needs of their customers.

Liferay Solutions

Ready to see what Liferay can do?

Challenges

Gulf Insurance Group-Kuwait felt they could improve their digital presence, in part because their custom-built web portal, native mobile applications, and website all used different platforms. The lack of consolidation contributed to a number of problems including:

- Delayed time to market.

Developing and publishing changes and updates for so many platforms cost Gulf Insurance Group-Kuwait time and valuable additional resources. - Limited online functionality.

The team didn’t have the bandwidth or platform capability to make more than a few products available online. Additionally, the customer portal had no claim submission or endorsement option. - Disorienting and inconsistent user experience.

Not only were applications disparate, but they were also siloed, meaning users got easily confused and frustrated with dissimilar interface and navigation experiences.

Implementation

The search for a new solution that would be able to bring together all their platforms into one ended with Liferay DXP, which hosts the website, customer portal, mobile applications, and a space for customers to make purchases.

With the assistance of Liferay Support and Liferay Platinum partner DPS Kuwait, Gulf Insurance Group-Kuwait went live in four phases over the course of one year. The unified solution is able to integrate with core insurance applications and other key technologies.

With the assistance of Liferay Support and Liferay Platinum partner DPS Kuwait, Gulf Insurance Group-Kuwait went live in four phases over the course of one year. The unified solution is able to integrate with core insurance applications and other key technologies.

Results

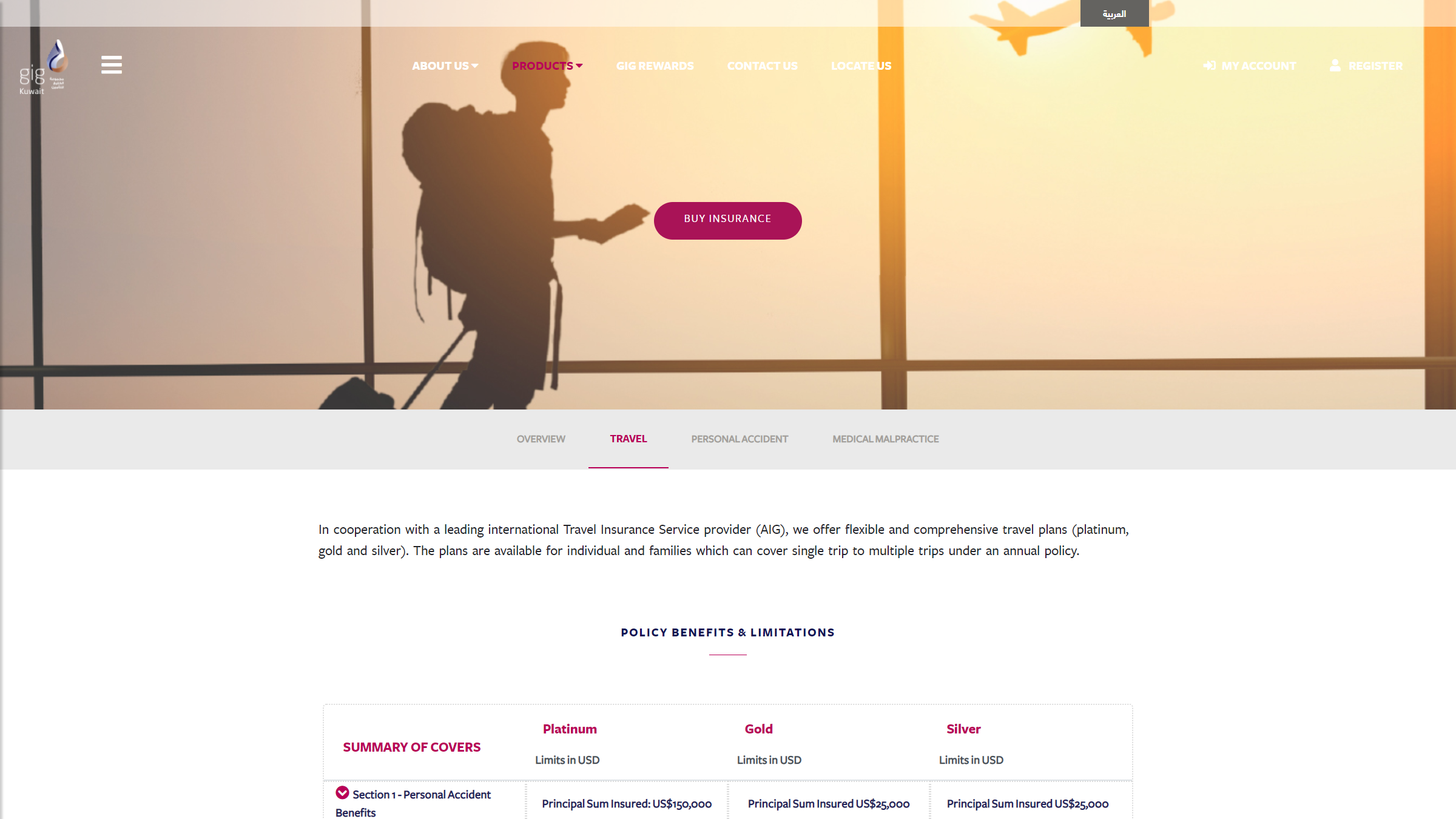

Going through a step-by-step customer journey, users can leverage the solution to purchase a new insurance policy or, for a more complex need, request a quote. With Liferay DXP, Gulf Insurance Group-Kuwait has become the first insurance company in the region to issue multiple insurance policies online and provide an online health claims approval system.

Since implementing their Liferay solution, Gulf Insurance Group-Kuwait has experienced the following benefits:

Since implementing their Liferay solution, Gulf Insurance Group-Kuwait has experienced the following benefits:

- 30% customer increase.

Because of new online features like single sign-on, claim submission, and endorsement capabilities, the overall customer base has increased, with digital engagement also improving. - Adaptability during challenging times.

The onset of the COVID-19 pandemic meant that physical offices and branches had to close, but Gulf Insurance Group-Kuwait was able to make 100% of their insurance products available digitally to continue serving customers. - Reduced time to market and TCO.

Time to market and total cost of ownership decreased not only because of the new unifying solution and the ease of identifying process bottlenecks, but also because of streamlined quote functionality using Liferay’s Form feature.

Building off of the success of their Liferay solution, Gulf Insurance Group-Kuwait plans to create a B2B portal for corporate customers. The B2B portal will allow branches, brokers, and agents to issue policies directly via Liferay instead of using complex core insurance applications. Adding this solution will support Gulf Insurance Group-Kuwait as they continue to provide high-quality products and services to their customers.