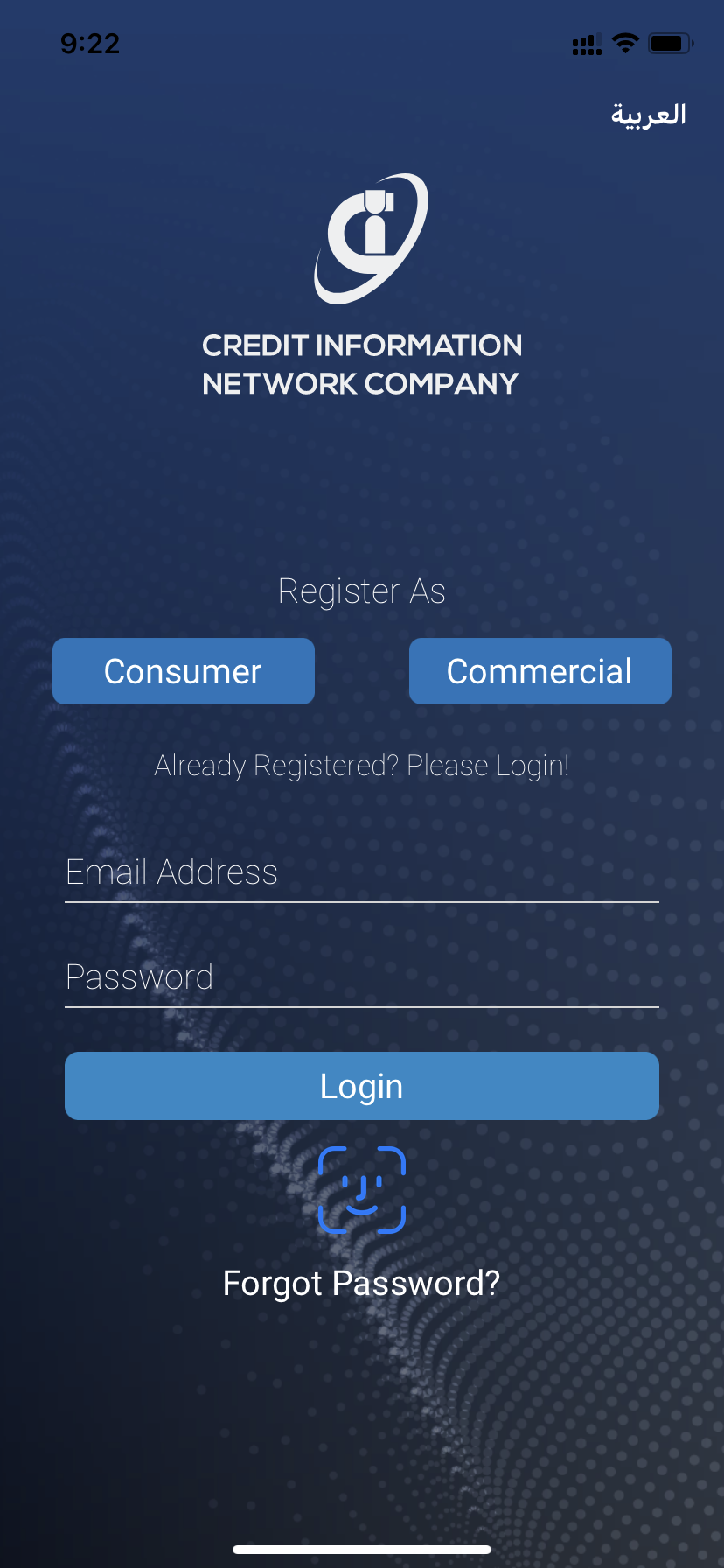

Ci-Net took their business online with Liferay DXP, building a website, mobile applications, and customer portal to revolutionize their digital strategy.

Shareholding Company Sees 30% Rise in Customer Registrations with New Online Platform

30%

Increase in Individual Customers

25%

Increase in Corporate Customers

3,000+

Users

Outline

Jump to Section

Key Takeaways

- Expand your customer base with an all-in-one digital experience.

Ci-Net’s individual customer base has grown by 30% now that customers can access everything they need online, with a 25% increase in corporate customers. - Boost customer satisfaction with easy self-service options.

With the new customer portal where users can log in and view their credit profile, check loan history, request a credit report, and more, Ci-Net customers are happier than ever. - Simplify administration with a consolidated platform.In Liferay, Ci-Net is able to manage all their solutions from one administration console, making it easy to identify and track issues and changes.

Background

Credit Information Network (Ci-Net) is a closed shareholding company based out of Kuwait that specializes in requesting, collecting, preserving, analyzing, and using credit information for preparing credit records. In addition to issuing customer-requested credit reports and classifications, Ci-Net is currently developing risk tools and standards in compliance with data protection laws.

Liferay Solutions

Ready to see what Liferay can do?

Challenges

Ci-Net had very little presence online, with no services available digitally, and customers had to visit a physical location any time they wanted to conduct business. To resolve the limitations of in-person-only services, Ci-Net started looking for a digital platform that would meet the following goals:

- Make online services available for individuals and corporations.

Because both individuals and businesses use Ci-Net to access credit and other financial information, Ci-Net needed a flexible platform to fit both B2C and B2B use cases. - Establish a digital Know Your Customer (KYC) process.

With business being conducted onsite, Ci-Net had minimal insight and data on customer behavior and trends. - Offer services through KIOSKs.

To provide their customers with every opportunity to interact with them, Ci-Net hoped to connect their services to KIOSKs at physical locations as well.

Implementation

Ci-Net turned to Liferay DXP to transform their digital strategy with a new platform, relying on Liferay Platinum partner DPS Kuwait and Liferay Support to help with the implementation process. Using an agile development approach to go live with individual services first and then corporate, the entire process took eight months from start to finish.

The platform is integrated with a back-end credit services information system application, SMS Gateway, a public authority for civil information application, and other important systems.

The platform is integrated with a back-end credit services information system application, SMS Gateway, a public authority for civil information application, and other important systems.

Results

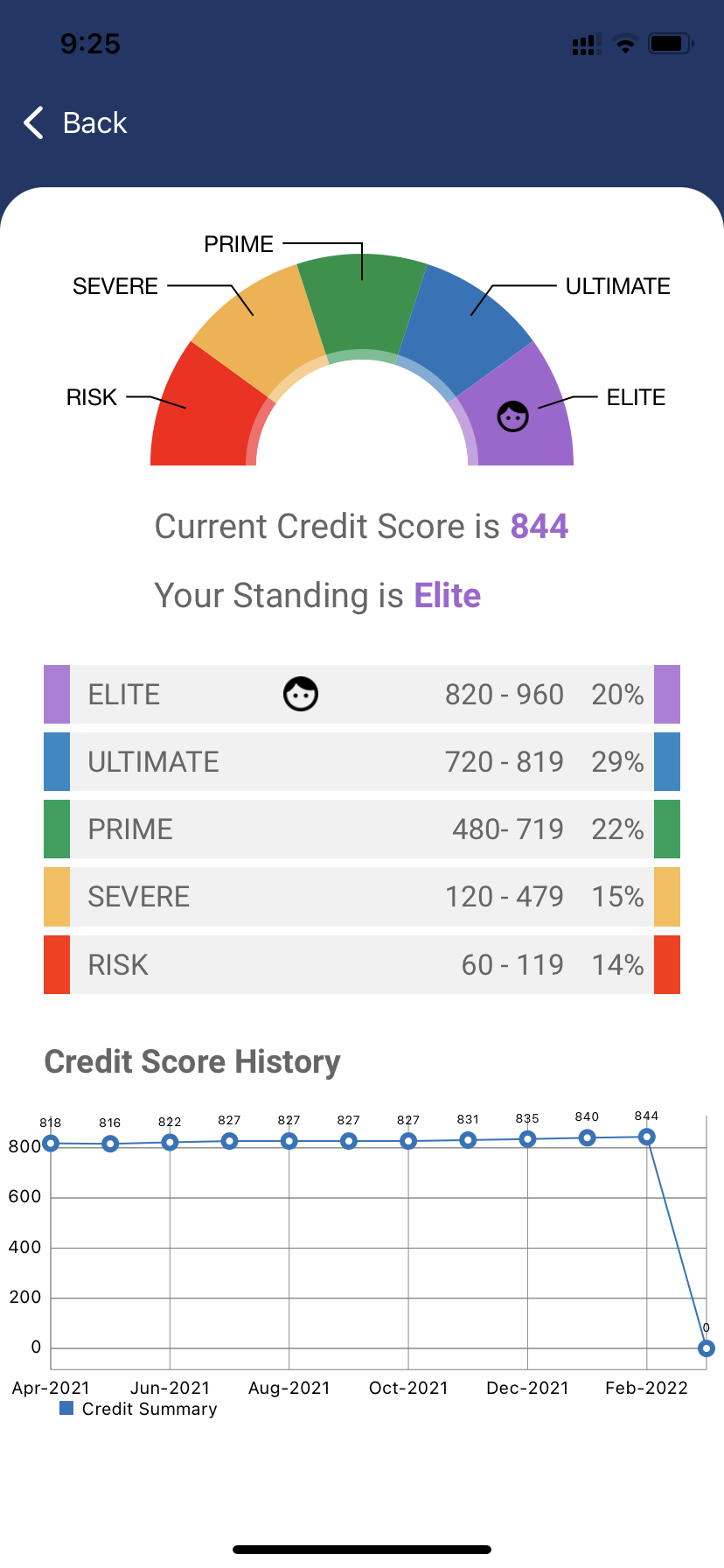

The new Liferay solution fulfills all of Ci-Net’s original goals, creating a single platform for multiple customer touchpoints via web, mobile applications, KIOSKs, and chatbot. A consolidated administration console allows Ci-Net to manage these solutions from one place. With SSO integration, users can log in from anywhere to view their credit profile, loans and loan history, check their credit score, find out ways to improve their credit, or request a credit report.

Post-implementation, Ci-Net has seen these tangible results:

Post-implementation, Ci-Net has seen these tangible results:

- 30% increase in their individual customer base and 25% increase in their corporate customer base.

New self-service features like the ability to subscribe to get updates on credit reports have encouraged new consumer and corporate registrations as part of a new initiative, even though corporate registrations have only been open for a few months. - Surge in overall customer satisfaction.

The combination of being able to self-service online and receiving better customer service at physical locations because of less traffic has improved satisfaction rates. - New income sources.

The success of the platform has enabled Ci-Net to explore other avenues of income generation, such as offering credit score improvement consultations.

With online self-service capabilities freeing up Ci-Net’s time to focus on other priorities, Ci-Net has been able to expand their portfolio of services. In the works are new initiatives like loan comparison and credit score improvement services, part of Ci-Net’s big-picture plan to equip their customers with the right financial tools.